Investing

We are not investment advisors and cannot recommend individual items as being suitable for investment or future growth. We can only advise on historical data which shows excellent growth in recent times. The following information is supplied as reference only.

The BENEFITS of purchasing RARE AUSTRALIAN BANKNOTES

Capital Growth

A long-term history of price growth over the past 40 years, averaging 10% or more per annum. The number one investment in Australia over the past 10 years according to the highly

respected Access Economics. (Note: past performance is no guarantee of future returns)

Rarity

Availability of rare items is strictly limited, as no more can be produced.

History

Australian banknotes are great barometers of social, economic and technological change, from the convict era through to current polymer issues.

Beauty

Australian banknotes include exquisite examples of engravers art and printers skill.

Manageable

Banknotes are easily stored and transported.

Annual fees

Banknotes do not attract annual taxes or maintenance fees, unlike bank interest, company and personal superannuation funds.

Discreet

Transactions are confidential as no title deeds need to be lodged with Statutory authorities.

Fund Approved

Rare Australian Banknotes are Federal Government approved for inclusion in company and personal superannuation funds. According to the Australian Taxation Office collectibles and fine art can be classified as legitimate investments for do-it-yourself super funds.

Deeming Benefits

Rare Australian Banknotes are not included under the extended deeming rules, since they are not income producing.

Diversification

Banknotes allow for diversification of a portfolio, and fall into the "cash" category of investment classes.

Control

Physical control over your valuable assets. Secure and fully insured storage of your banknotes arrange for your peace of mind.

Saleability

Rare Australian Banknotes are easily realisable due to the strong demand. All or part of your banknote portfolio can be sold at any time.

Taxis and Brisbane deliver the best ride - Morgan Mellish

Collectible banknotes, Brisbane houses and Sydney taxi plates - this was where you should have had your money over the past year as world share markets slumped.

Collectible banknotes, Brisbane houses and Sydney taxi plates - this was where you should have had your money over the past year as world share markets slumped.

These areas recorded the biggest gains in the last survey of asset prices, leaving for dead international shares, Sydney CBD property and wheat-growing land, which all lost value.

The study by Access Economics found investments in shares, bonds and art fared badly compared with real estate. Australian shares had a disappointing year, up less than 5 per cent.

However, the forecaster is in no doubt the housing bubble is about to burst. "There are plenty of signs that something has to give," it said in its asset price survey. "This will end in tears."

International shares, which fell more than 10 per cent last financial year, have been near the top of the league table for the past decade. But they have not outperformed banknotes, Australian wine or thoroughbred horses.

"It turns out it was better to have bought thoroughbreds than to have bet on them," said Access Economics director Chris Richardson.

Among the banknotes, even clips of 10 well-preserved $2 notes - which were removed from circulation in 1988 - now sell for up to $35, a rise in value of 75 per cent.

Australian wine is measured by the value of 1971 Penfolds Grange Hermitage, which now sells for up to $700 a bottle, close to a fivefold increase since 1990.

For the past financial year, and for the past decade, Australian art has been a poor performer, although individual artists varied greatly.

Those enjoying the biggest rises in the past five years were John Olsen, Sydney Nolan and Arthur Boyd. At the other end, falling prices were experienced for Hans Heysen and Donald Friend.

While Sydney taxi plates did well last year, Melbourne plates - where competition is more restricted - fared better over the past decade. Source: Australian Financial Review September 2002

Australian Banknotes as an Investment

The following interesting points were made in an article written for the Sunday Mail May 14 2000:

Banknotes were prominent as an asset in the surveys conducted.

Banknotes, along with art, were the strongest performers between 1998 and 1999, beating Sydney CBD property and international shares.

Banknotes appreciated in value by more that 60% between 1994 and 1999.

Coins were among a number of assets that grew faster than inflation in the past 10 years.

Over a 10 year period from 1990-2000 Australian banknotes rated higher than vintage wines, thoroughbred horses, national and international shares.

Both pre decimal and decimal paper banknotes will never be produced again!

Star Replacement Notes

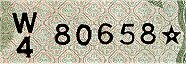

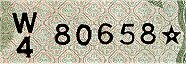

Example of a Pre-Decimal Star Replacement serial number

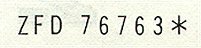

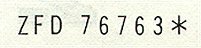

Example of a Decimal Star Replacement serial number

Star replacement notes are specially printed notes that have the last digit of their serial number replaced by a star. They were used between 1942 and 1971 to replace notes damaged or

spoilt during the printing process. During this period each bundle of 100 notes was hand checked and any faulty notes were removed and replaced by a star note in order to keep the bundle in numerical order.

With the advent of counting machines the system was no longer required and was abolished in 1971. There were 2 different styles of star used. The Pre Decimal notes have a proper 5 point star whilst the Decimal notes have an asterisk. Both styles are shown above.

Star replacement notes are considered rare, especially in higher grades.

The BENEFITS of purchasing RARE AUSTRALIAN BANKNOTES

Capital Growth

A long-term history of price growth over the past 40 years, averaging 10% or more per annum. The number one investment in Australia over the past 10 years according to the highly

respected Access Economics. (Note: past performance is no guarantee of future returns)

Rarity

Availability of rare items is strictly limited, as no more can be produced.

History

Australian banknotes are great barometers of social, economic and technological change, from the convict era through to current polymer issues.

Beauty

Australian banknotes include exquisite examples of engravers art and printers skill.

Manageable

Banknotes are easily stored and transported.

Annual fees

Banknotes do not attract annual taxes or maintenance fees, unlike bank interest, company and personal superannuation funds.

Discreet

Transactions are confidential as no title deeds need to be lodged with Statutory authorities.

Fund Approved

Rare Australian Banknotes are Federal Government approved for inclusion in company and personal superannuation funds. According to the Australian Taxation Office collectibles and fine art can be classified as legitimate investments for do-it-yourself super funds.

Deeming Benefits

Rare Australian Banknotes are not included under the extended deeming rules, since they are not income producing.

Diversification

Banknotes allow for diversification of a portfolio, and fall into the "cash" category of investment classes.

Control

Physical control over your valuable assets. Secure and fully insured storage of your banknotes arrange for your peace of mind.

Saleability

Rare Australian Banknotes are easily realisable due to the strong demand. All or part of your banknote portfolio can be sold at any time.

Taxis and Brisbane deliver the best ride - Morgan Mellish

Collectible banknotes, Brisbane houses and Sydney taxi plates - this was where you should have had your money over the past year as world share markets slumped.

Collectible banknotes, Brisbane houses and Sydney taxi plates - this was where you should have had your money over the past year as world share markets slumped.These areas recorded the biggest gains in the last survey of asset prices, leaving for dead international shares, Sydney CBD property and wheat-growing land, which all lost value.

The study by Access Economics found investments in shares, bonds and art fared badly compared with real estate. Australian shares had a disappointing year, up less than 5 per cent.

However, the forecaster is in no doubt the housing bubble is about to burst. "There are plenty of signs that something has to give," it said in its asset price survey. "This will end in tears."

International shares, which fell more than 10 per cent last financial year, have been near the top of the league table for the past decade. But they have not outperformed banknotes, Australian wine or thoroughbred horses.

"It turns out it was better to have bought thoroughbreds than to have bet on them," said Access Economics director Chris Richardson.

Among the banknotes, even clips of 10 well-preserved $2 notes - which were removed from circulation in 1988 - now sell for up to $35, a rise in value of 75 per cent.

Australian wine is measured by the value of 1971 Penfolds Grange Hermitage, which now sells for up to $700 a bottle, close to a fivefold increase since 1990.

For the past financial year, and for the past decade, Australian art has been a poor performer, although individual artists varied greatly.

Those enjoying the biggest rises in the past five years were John Olsen, Sydney Nolan and Arthur Boyd. At the other end, falling prices were experienced for Hans Heysen and Donald Friend.

While Sydney taxi plates did well last year, Melbourne plates - where competition is more restricted - fared better over the past decade. Source: Australian Financial Review September 2002

Australian Banknotes as an Investment

The following interesting points were made in an article written for the Sunday Mail May 14 2000:

Banknotes were prominent as an asset in the surveys conducted.

Banknotes, along with art, were the strongest performers between 1998 and 1999, beating Sydney CBD property and international shares.

Banknotes appreciated in value by more that 60% between 1994 and 1999.

Coins were among a number of assets that grew faster than inflation in the past 10 years.

Over a 10 year period from 1990-2000 Australian banknotes rated higher than vintage wines, thoroughbred horses, national and international shares.

Both pre decimal and decimal paper banknotes will never be produced again!

Star Replacement Notes

Example of a Pre-Decimal Star Replacement serial number

Example of a Decimal Star Replacement serial number

Star replacement notes are specially printed notes that have the last digit of their serial number replaced by a star. They were used between 1942 and 1971 to replace notes damaged or

spoilt during the printing process. During this period each bundle of 100 notes was hand checked and any faulty notes were removed and replaced by a star note in order to keep the bundle in numerical order.

With the advent of counting machines the system was no longer required and was abolished in 1971. There were 2 different styles of star used. The Pre Decimal notes have a proper 5 point star whilst the Decimal notes have an asterisk. Both styles are shown above.

Star replacement notes are considered rare, especially in higher grades.

|